Papaya are a free of charge application for Android otherwise apple’s ios profiles one to allows you to spend bills during your cellular telephone. Capture a photograph of the expenses, establish the newest payment approach, and then song the new condition of your own fee. To make a fees thanks to an expenses fee service, you select the fresh payee, percentage amount, and payment date.

- Klarna is actually a functional and you will simpler percentage platform which provides an excellent list of functions to help you the users.

- The majority of us performed, because the debit cards managed to get simple to fund some thing without needing an excellent fistful of report costs.

- You could eliminate three of your own newest lender comments to determine what costs you’ve been paying.

- If you would like make a cost punctual, it’s far better make use of the application otherwise website.

- You can look at your payment provides canned as well as your bill is paid back.

- For many who’re searching for a new mastercard, it is only you to definitely small thing to consider along with a lot more important things such Apr, yearly charges and you may perks applications.

My personal Verizon application – Turn on The new Line Using Previously owned Tool

Authenticate your account and enter your money and you will routing amount to expend using your checking or savings account. With Car Spend, using the payment couldn’t getting simpler. You can approve the expenses becoming instantly debited from the examining or bank account. We still read the meter and you will estimate your own expenses per few days. The amount billed might possibly be instantly drawn up for the date shown on your own bill. Obtain the brand new Wells Fargo Cellular app to plan and you will make ends meet safely, straight from the smart phone.

The following is when you should — and you will should not — have fun with autopay for your costs

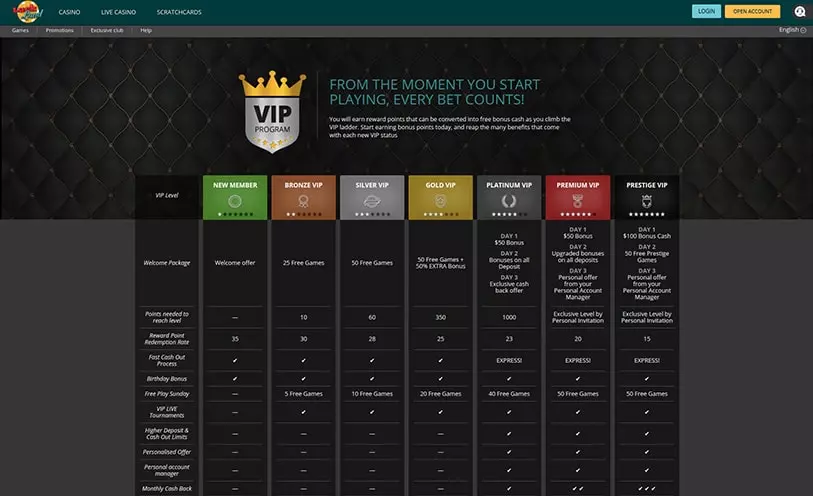

We’ve made sure one to, and having a great list of video game and https://happy-gambler.com/spartan-slots-casino/ you can bonuses, the newest casinos in the above list all undertake this style of payment therefore deploying it might possibly be brief, basic smooth to you. Everything you need to do in order to utilize this services is come across Payforit whenever you go to put currency. Dependent on and therefore mobile provider you use, you might be questioned to adhere to between one to about three actions to ensure the newest charges. You may need to enter your contact number and the local casino ID and password, but that’s all information that is required.

Playing from the spend because of the mobile phone bill casinos also offers some very nice benefits the real deal money professionals. Yet not, you can find always drawbacks to several gambling enterprise commission steps; learn the pros and cons away from shell out by the cellular telephone casinos below. I’ve checked away many of these organization by purchasing a cheap plan for thirty days, and perform some ditto! Monthly preparations start as low as $5-ten, that’s well worth spending to see if your’ll be satisfied with this service membership.

Ow-costs providers render smaller works closely with agreements between just $5-thirty-five a month. The prices are very different depending on your choice of has along with place study restrict, around the world getting in touch with, and extra lines. Tello cell phone preparations continue something simple with their wireless service. None of those hidden charge otherwise long-term contracts that may leave you feeling involved. This is especially true for all of us whose cell phone is the number one or merely interaction equipment. That have a radio package that suits their demands becomes much more very important.

To take action inside an actual physical store, you can utilize people contactless critical. From the checkout, open your mobile phone which have an excellent passcode, Touch ID, otherwise Face ID, and you may faucet your own Fruit tool to your terminal to pay. You might shell out with your phone in areas anywhere the thing is that the fresh contactless icon. To utilize their cellular telephone making an installment, just tap otherwise keep their unit across the card viewer and hold back until you see a check draw or a great “done” symbol to ensure the brand new commission experienced. A digital wallet areas your commission information and you can makes you spend with your phone in places.

If the loved ones agreements aren’t an option, you can also downgrade so you can a less expensive bundle one to’s affordable. This might have going for a good prepaid service bundle that really needs a great high lump sum in advance, but advantages your which have less price for that name total. It’s some time for example paying-side to have automobile insurance, rather than a monthly rates that could probably full moreover the length of the definition of. Verizon members of the family agreements initiate incredibly barebones, providing 5G access and you can unlimited research that is subject to throttling any moment. Its middle-level “Gamble Far more” and you will “Create More” preparations are 50GB away from premium analysis, 25GB out of superior mobile hotspot research, offers on the Websites, and a room from incentives.

By storing the commission procedures or any other very important notes all to the the cellular telephone, you get rid of the need to hold the majority of your paper and you will plastic material. Apple Pay try a contactless means for apple’s ios pages and then make repayments. It spends biometric tests technology named Deal with ID otherwise Reach ID, you can also play with an excellent passcode to get into the new wallet. You can add one debit otherwise credit card in addition to Apple Bucks, boarding tickets, enjoy seats, provide cards and a lot more to your handbag.

It do well at quick transactions, preventing the importance of having dollars, and this can use not merely when you shop but also for casual things. Cellular programs taking contactless money have become preferred because the addition of Near Community Correspondence (NFC), flipping individual cellphones for the equivalent of a fees card. The best features to the the checklist tend to discuss everyday household costs as well as websites, cellular telephone, cord plus both scientific expenses.

And make money to own a free account which was closed more than six days back

After triggering the deal(s), purchase the items and you will publish a duplicate of the receipt so you can Checkout 51. Someone for example having fun with Checkout 51 as you may search now offers from your computer as well as the mobile app. Even though some also offers are store-particular, you might get almost all any kind of time shop within the-individual or online. When your benefits equilibrium has reached $5, you should buy paid off by PayPal or look at.

When using other people’s cellular telephone bills, we would like to stop any extra fees to have “payment assistance” energized by companies. Such put a $5-ten commission to pay for price of broker guidance. Rectangular is actually one of the first enterprises to figure out mobile money, sans NFC. Its brand new Square Handbag application enable you to check into a store, walk-in and possess what you want, following below are a few for the cashier scraping a pop music-upwards of your deal with off their Rectangular Register software. Once you seemed inside, you did not need touching your own cellular telephone once more to pay. Only as well as your rent or homeloan payment isn’t enough when you budget for your own property will cost you.

If you would like your cellular phone and can ensure that it it is to possess many years, it can save you that money and use it with other something, if not save they to possess an alternative cellular phone later along the street. We advice exploring the newest May find Cash return Charge card. There’s no yearly fee and see often suits the bucks straight back your’ve gained inside first 12 months. You can find opportunities to secure as much as 5% cash return for the certain orders, nevertheless’ll earn step one% cash back minimum.

It means you intend how you offer, save, spend and you will dedicate your entire earnings. In that way you don’t get to the avoid of one’s week and you may wonder where all currency went— you understand. Even though these expenditures only appear every once within the a great when you are, your don’t want them so you can surprise both you and throw off your own month-to-month funds. All of these missing items won’t send you on the worry mode since you may merely sneak him or her to your miscellaneous group. In case a certain bills features dropping here, it’s time for you to give it an alternative funds range all the its individual. It might seem counterintuitive to incorporate traces to down the bill.

Utilize this technique to your any other membership you’lso are using. Organizations have to continue consumers and therefore are prepared to discuss — however, since the majority anyone don’t, they’lso are leaving cash on the fresh desk. How to do this would be to create a little while away from research to help you right back your upwards first.

Another thing to be on the lookout for with the functions is getting payments otherwise wants funds from the individuals you don’t understand. Well-recognized cons include people giving your a pile of cash due to the brand new software and you can asking you for payment. A familiar fraud is the fact that the way to obtain the brand new commission to your originates from a stolen charge card. If you accept that money, you could find on your own within the strong legal doo-doo. The most buzzworthy mobile payment option is fellow-to-fellow payments, while the exemplified from the Venmo.

Quicken Antique bookkeeping application includes bill pay as part of their Premier package. The master plan will set you back $5.99 a month (billed annually) and you will has additional features, and using products, taxation records and you will savings account reconciliation. You also are able to use the software to create a resources and you can forecast expenses to help you control your profit. On line bettors has other cellular asking characteristics to select from when playing at the shell out from the cellular phone casinos.

It states be much more safe than just playing with a traditional credit credit as the credit count is not individually sent, and you will secure through multiple-coating protection encryption. Of many statement commission services are tailored for the older adults that are not in a position to create their currency. You will get a devoted account manager which assesses and you will pays monthly or you to-day bills.

You can constantly discover this article to the banking webpage away from the net local casino. You may need to log in to comprehend the banking tips readily available and the charges recharged. Boku are a different payment merchant, and you may Payforit and Fonix try commission options established in venture having the top United kingdom cellular providers.

There are laws encompassing what employees are entitled to whenever considering settlement for personal cellular telephone explore. MVNOs (Cellular Virtual System Workers), concurrently, usually do not own and you will perform their technical and you will alternatively piggyback out of of the services of one of your own more than brands. This permits them to become much less expensive than the main providers however, entails these are the basic as restricted through the top utilize symptoms plus don’t access as numerous more professionals. Better yet, a regular strategy at the T-Cellular has got the service provider waiving the cost of a 3rd range of data, very families of five get one to fourth line at no cost. Cause of reduced prices for registering for autopay, and you can save a lot of money. But if you is also move the brand new $300 upfront costs, it At the&T prepaid bundle is a wonderful treatment for protect an excellent low-rate ahead.