This will give us the total dollar amount in sales that will we need to achieve in order to have zero loss and zero profit. Now we can take this concept a step further and compute the total number of units that need to be sold in order to achieve a certain level profitability with out break-even calculator. The break-even formula in sales dollars is calculated by multiplying the price of each unit by the answer from our first equation. A breakeven point tells you what price level, yield, profit, or other metric must be achieved not to lose any money—or to make back an initial investment on a trade or project. Thus, if a project costs $1 million to undertake, it would need to generate $1 million in net profits before it breaks even. The breakeven point is important because it identifies the minimum sales volume needed to cover all costs, ensuring no losses are incurred.

O que é o breakeven?

Similarly, If a competitor starts offering big discounts, your projected sales might drop and may cause you to miss your break-even point. The contribution margin per car lets you know that after the variable expenses are covered, each car serviced will provide or contribute $15 toward the Oil Change Co.’s fixed expenses of $2,400 per week. After the $2,400 of weekly fixed expenses accounting software: email settings in xero has been covered the company’s profit will increase by $15 per car serviced. In our example above, Maria’s break-even point tells her she needs to create eight quilts a month, right? But what if she knows she can create only six a month given her current time and resources? Well, per the equation, she might need to up her cost per unit to offset the decreased production.

How Cutting Costs Affects the Breakeven Point

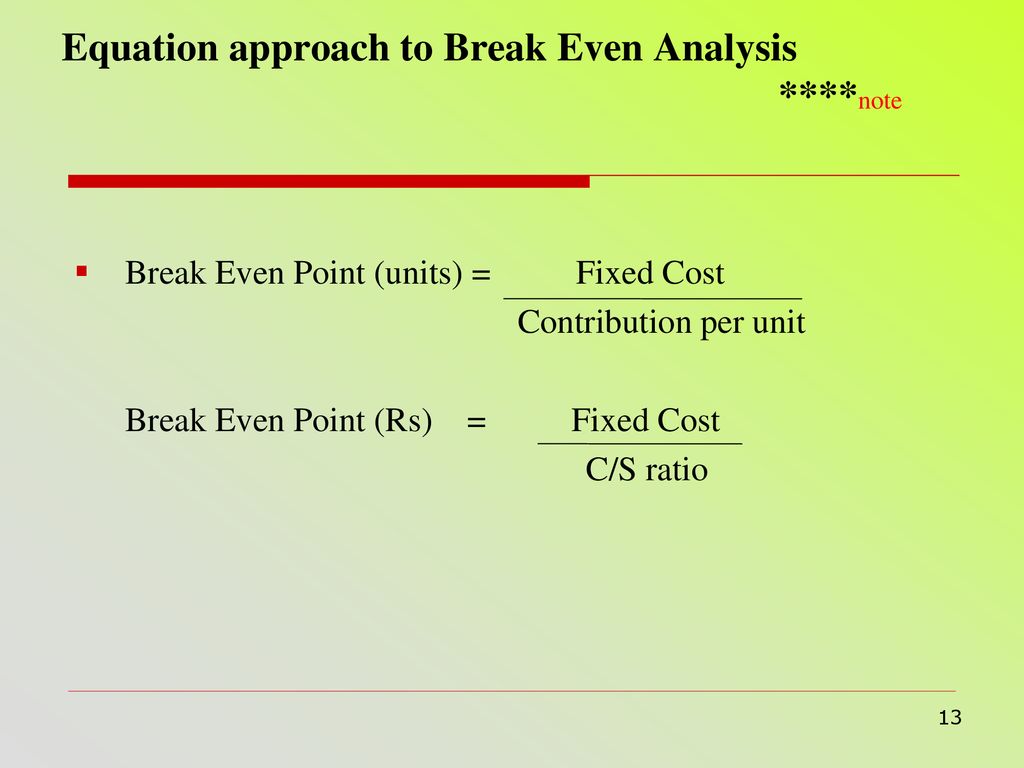

Note that in the prior example, the fixed costs are “paid for” by the contribution margin. The more profit a company makes on its units, the fewer it needs to sell to break even. To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Break-even analysis involves a calculation of the break-even point (BEP). The break-even point formula divides the total fixed production costs by the price per individual unit less the variable cost per unit. This formula helps you determine the total revenue required to cover your operating expenses, based on your business’s gross margin.

Call Option Breakeven Point Example

In essence the company needs to cover the equivalent of $3,600 of fixed expenses each week. An example would be a salesperson’s compensation that is composed of a salary portion (fixed expense) and a commission portion (variable expense). The variable portion can be listed with other variable expenses and the fixed portion can be included with the other fixed expenses.

This ratio indicates the percentage of each sales dollar that is available to cover a company’s fixed expenses and profit. The ratio is calculated by dividing the contribution margin (sales minus all variable expenses) by sales. The break-even point is equal to the total fixed costs divided by the difference between the unit price and variable costs. This break-even calculator allows you to perform a task crucial to any entrepreneurial endeavor.

- In reality, prices often fluctuate due to market conditions, competition, or changes in demand.

- Financial terms and calculations includes revenue, costs, profits and loss, average rate of return, and break even.

- The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time.

- This margin indicates how much of each unit’s sales revenue contributes to covering fixed costs and generating profit once fixed costs are met.

The breakeven point is the production level at which total revenues for a product equal total expenses. The breakeven point can also be used in other ways across finance such as in trading. When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs before profit generation can begin. The break-even point formula can determine the BEP in product units or sales dollars. The Break Even Revenue Calculator is a vital tool for understanding how much revenue you need to generate in order to cover your operating expenses.

At that breakeven price, the homeowner would exactly break even, neither making nor losing any money. This point is also known as the minimum point of production when total costs are recovered. In accounting, the margin of safety is the difference between actual sales and break-even sales.

It’s the amount of sales the company can afford to lose but still cover its expenditures. First we need to calculate the break-even point per unit, so we will divide the $500,000 of fixed costs by the $200 contribution margin per unit ($500 – $300). This computes the total number of units that must be sold in order for the company to generate enough revenues to cover all of its expenses.